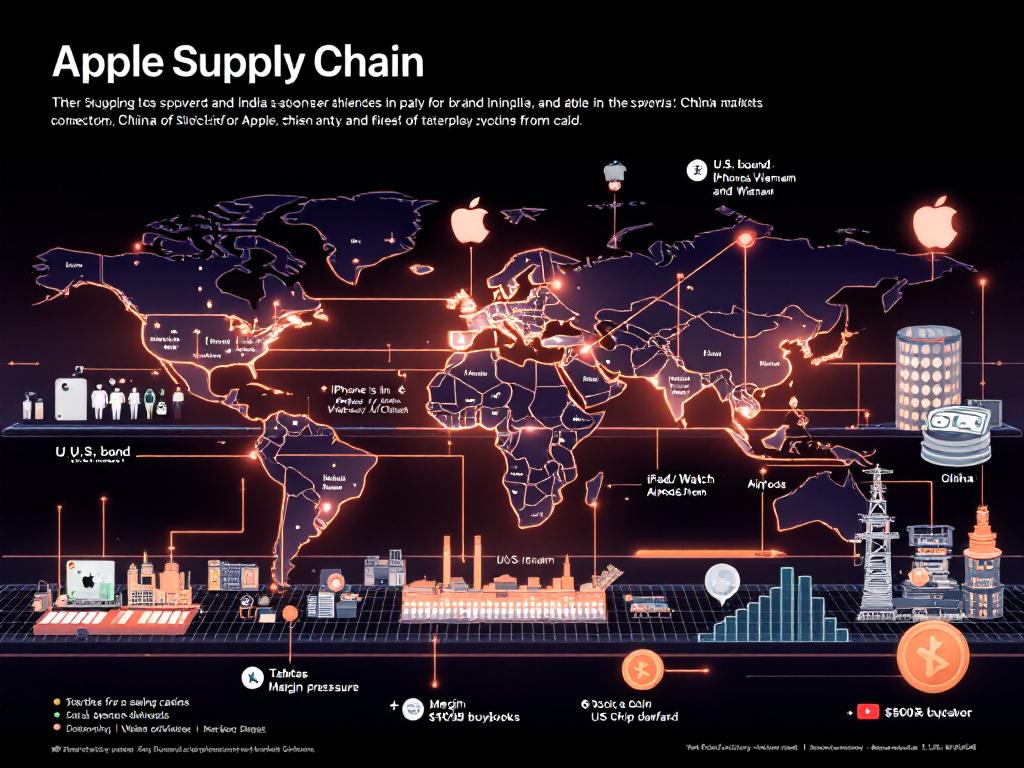

A sleek Apple supply-chain scene: a world map highlighting the U.S., India, Vietnam, and China with glowing connection lines. In the foreground, iPhones labeled “U.S.-bound” on an assembly line in India, iPads/Macs/Apple Watch/AirPods flowing from Vietnam, while a vast China factory hub feeds “Global” markets. Subtle icons indicate tariffs (price tag with arrows), margin pressure (slim bar chart), and stock dip (small downward line). Include Apple’s financial actions: a stack of cash with “$100B buybacks,” a rising dividend coin, and a U.S. chip wafer symbol. Clean,

Summary

Apple is accelerating a strategic supply-chain reorientation to mitigate rising U.S. tariffs, moving most iPhone production for the U.S. market to India and shifting iPads, Macs, Apple Watches, and AirPods for U.S. buyers to Vietnam, while maintaining China as the primary source for products sold outside the U.S. Despite better-than-expected quarterly results and robust services growth, Apple’s shares dipped on a slight services revenue miss and guidance implying modest growth and margin pressure, alongside an estimated ~$900 million tariff cost impact in the June quarter. The company is bolstering U.S. investments, expanding chip sourcing domestically, and authorizing substantial buybacks and a dividend increase as it navigates tariff headwinds and positions future products, including Apple Intelligence features, for supported regions.

Key Points

- Apple will produce most U.S.-bound iPhones in India and shift other device production for the U.S. to Vietnam, reducing reliance on China.

- Tariffs are expected to add about $900 million in costs this quarter, pressuring margins despite overall revenue and EPS beats.

- China remains the primary manufacturing base for Apple products sold outside the U.S., with China sales slightly declining.

- Apple’s stock fell after a minor services revenue miss despite double-digit services growth and stronger-than-feared iPhone performance.

- Apple approved $100B in buybacks, raised its dividend, and is expanding U.S. investments and chip sourcing.