Articles in this Cluster

31-05-2025

CPAC held back-to-back events in Hungary and Poland, showcasing a deepening alliance between the Trump White House and Europe’s populist right. Hungary’s Viktor Orbán praised Trump’s return, while Trump sent a video lauding Orbán and CPAC. The gatherings featured far-right European leaders and U.S. influencers, with DHS Secretary Kristi Noem urging Polish voters to back conservative candidate Karol Nawrocki—an unusual intervention in an allied nation’s election. The events highlight shared priorities on immigration, speech, and sovereignty amid strained U.S.-EU relations and delayed U.S. tariffs on EU goods. CPAC chair Matt Schlapp said the movement will expand globally with planned conferences in Australia, Japan, Brazil, Mexico, and more.

Entities: CPAC, Donald Trump, Viktor Orbán, Karol Nawrocki, Kristi Noem • Tone: analytical • Sentiment: neutral • Intent: inform

31-05-2025

Jim Cramer says next week’s key market drivers are the nonfarm payrolls report and earnings from Broadcom, Lululemon, CrowdStrike, and major dollar stores. He believes a strong jobs number would keep the Fed from cutting rates and push longer-term yields higher; a weak report likely still won’t trigger cuts due to tariff-driven inflation. He wants clarity from Fed Chair Powell on handling inflation pressures.

Cramer expects pressure on Campbell’s margins and sees GLP-1 weight-loss drugs as a headwind for food and alcohol names like Brown-Forman. He’s cautious but sticking with CrowdStrike despite sector jitters. Dollar General, Dollar Tree, and Five Below may post solid quarters thanks to pre-tariff stocking, but guidance could suffer as tariffs force price hikes or margin hits. He’s positive on Cracker Barrel’s turnaround and value positioning, bullish on Broadcom, and notes China remains a relative bright spot for Lululemon. He says a “goldilocks” jobs report (flat jobs and wages) could lift markets, but overall expects inflation to rise as retailers pass on tariff costs.

Entities: Jim Cramer, Federal Reserve, Jerome Powell, nonfarm payrolls report, Broadcom • Tone: analytical • Sentiment: neutral • Intent: analyze

31-05-2025

The EU condemned President Trump’s decision to double U.S. steel tariffs to 50%, saying it undermines negotiations, adds global economic uncertainty, and raises costs for consumers and businesses. Brussels warned it is ready to impose countermeasures, with existing and additional measures set to automatically take effect by July 14 if no deal is reached. The tariff hike, announced at a U.S. Steel rally and effective June 4, drew criticism from the United Steelworkers in Canada, who warned of job risks and urged a strong response. Meanwhile, a U.S. trade court briefly halted many country-specific tariffs before an appeals court paused that ruling, injecting legal uncertainty into the administration’s broader trade strategy.

Entities: European Union, Donald Trump, U.S. steel tariffs, Brussels, United Steelworkers (Canada) • Tone: analytical • Sentiment: negative • Intent: inform

31-05-2025

Jim Cramer urged caution on teen apparel stocks after reviewing Abercrombie & Fitch and American Eagle earnings. He favored Abercrombie, citing CEO Fran Horowitz’s turnaround, supply-chain diversification, and Hollister’s same-store sales growth, though the company cut guidance due to tariffs. He viewed American Eagle negatively after an earnings miss, a $75 million write-down, reduced guidance, and a puzzling $200 million buyback that could limit flexibility. Noting teen consumers’ fickleness and tariff pressures, Cramer suggested Abercrombie may be a buy as soon as next week and even considered deep-in-the-money calls ahead of an upcoming JPMorgan event with management. Both stocks are down sharply year-to-date.

Entities: Jim Cramer, Abercrombie & Fitch, American Eagle, Fran Horowitz, Hollister • Tone: analytical • Sentiment: neutral • Intent: analyze

31-05-2025

Stocks ended the week choppy but higher overall as tariff headlines drove swings. The S&P 500 rose about 2% for the week and over 6% in May, its best month since Nov 2023, helped by Trump’s delay of EU tariffs despite renewed tensions with China and potential broader tech restrictions. Nvidia led earnings, beating estimates and guiding strongly despite China export limits; shares jumped then pared gains. Costco delivered a “perfect quarter” with strong margins and comps; Salesforce beat but fell as investors questioned its AI focus. The CNBC Investing Club trimmed Broadcom after big gains and downgraded it and GE Vernova to “buy on pullback,” while lifting GE Vernova’s target; Broadcom reports next week. Inflation data (core PCE) cooled in April, supporting easing price pressures, but tariffs could reignite inflation. Fed minutes showed a cautious stance; Chair Powell met Trump, reiterating policy depends on incoming data.

Entities: S&P 500, Donald Trump, European Union tariffs, China, Nvidia • Tone: analytical • Sentiment: neutral • Intent: inform

31-05-2025

CNN reports that even if courts curtail President Trump’s use of emergency powers to impose broad tariffs, his administration plans to revive or maintain import taxes using other trade laws. Four key tools are on the table: Section 122 (temporary tariffs up to 15% for 150 days to address trade deficits, requiring later congressional approval), Section 232 (sector-specific tariffs on national security grounds, like existing steel and aluminum duties), Section 301 (tariffs after investigations of unfair foreign practices, with no cap on size or duration), and Section 338 (unused authority allowing tariffs up to 50% against discriminatory practices, but likely violating WTO rules and provoking retaliation). Officials say these options preserve leverage in ongoing bilateral talks despite a legal setback, and that Trump remains committed to higher tariffs.

Entities: Donald Trump, CNN, Section 122, Section 232, Section 301 • Tone: analytical • Sentiment: neutral • Intent: inform

31-05-2025

CNN analysis highlights how Republicans are struggling to defend disruptive economic and social policy changes under Trump. Sen. Joni Ernst drew backlash after responding to concerns that Medicaid cuts would cause deaths by saying, “Well, we all are going to die,” later offering a sarcastic apology and arguing the GOP aims to “strengthen” Medicaid. The piece notes CBO projections that GOP Medicaid changes, including work requirements, would leave 7.6 million uninsured by 2034, and challenges Ernst’s claim about undocumented immigrants on Medicaid. It situates Ernst’s remarks alongside other flippant defenses: Trump minimizing tariff impacts by suggesting kids have fewer dolls, and Commerce Secretary Howard Lutnick implying only “fraudsters” complain about missing Social Security checks. The article argues such comments fuel Democratic attacks that the GOP’s agenda is callous and politically risky, especially on entitlements where there are few defensible talking points.

Entities: Joni Ernst, Donald Trump, Republican Party (GOP), Medicaid, Congressional Budget Office (CBO) • Tone: analytical • Sentiment: negative • Intent: analyze

31-05-2025

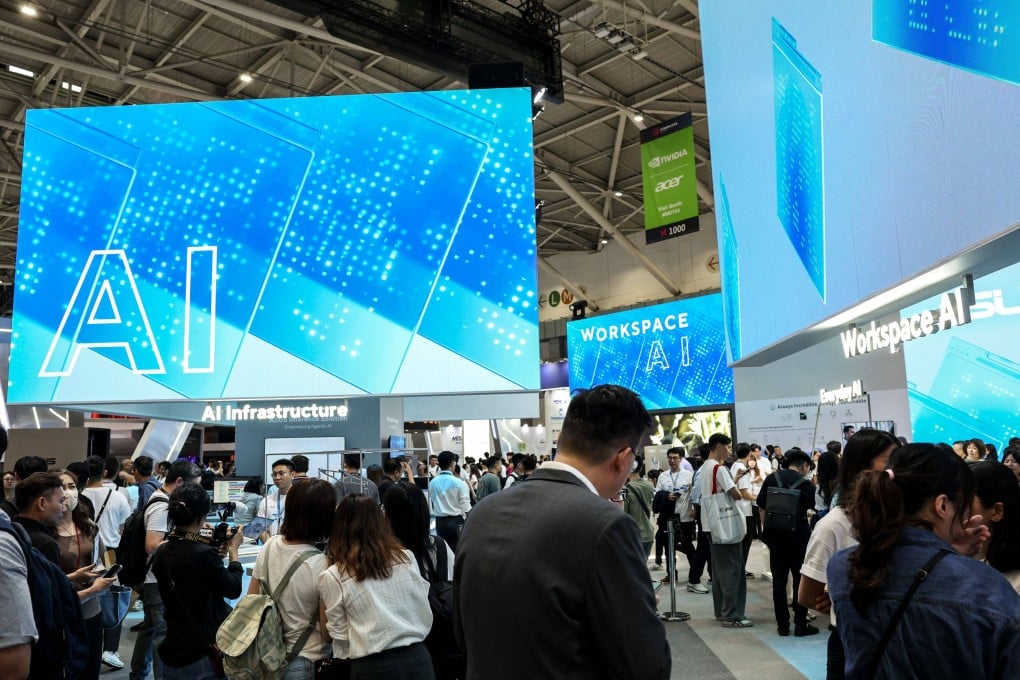

Computex Taipei 2025 showcased incremental AI-related hardware upgrades—like AI-activated peripherals and improved 3D displays—rather than breakthrough launches, despite Nvidia’s continued prominence. Beneath the surface, the dominant concern was geopolitical: fears that a potential return of high US tariffs on Taiwan, hinted at by Donald Trump, could hit Taiwan’s export-driven tech sector hard. While Taiwan’s economy recently benefited from AI demand—with strong Q1 2025 growth—industry sentiment at Asia’s biggest tech expo was overshadowed by uncertainty over US–Taiwan trade relations.

Entities: Computex Taipei 2025, Taiwan, Nvidia, Donald Trump, US–Taiwan trade relations • Tone: analytical • Sentiment: negative • Intent: inform

31-05-2025

The South China Morning Post’s US Economy, Trade & Business page highlights escalating trade tensions under President Trump, including plans to double steel tariffs to 50%, threats of 50% tariffs on the EU, and ongoing legal battles over his broad “reciprocal” tariff regime. Courts briefly blocked some tariffs, prompting White House pushback and an appeals court allowing duties to continue. US-China trade friction remains central: US retailers are pushing Chinese suppliers to absorb up to two-thirds of tariff costs; US farmers face weak soybean exports; smartphone exports from China to the US have plunged; and ports brace for disruptions despite truce signals. Meanwhile, the SEC dropped its case against Binance, signaling a friendlier crypto stance. Corporate and tech angles include Nvidia’s critique of US chip bans on China and debates over tariffs on Chinese cranes. Harvard is suing the administration over foreign student restrictions. Despite tensions, some sectors show resilience or shifts: Alibaba.com reports a surge in US buyer inquiries post-truce; China’s industrial output remains solid; and foreign investment flows into China’s theme-park market.

Entities: South China Morning Post, Donald Trump, US-China trade, tariffs, US Court of Appeals • Tone: analytical • Sentiment: neutral • Intent: inform