Articles in this Cluster

30-06-2025

Asia-Pacific stocks were mixed Monday as investors weighed weak economic data and trade uncertainties. China’s manufacturing PMI contracted for a third straight month, lifting stimulus hopes; the CSI 300 rose 0.39% while Hong Kong’s Hang Seng fell 0.29% despite gains in tech names. Japan’s Nikkei hit an 11-month high, closing up 0.84%, with Topix up 0.43%. South Korea’s Kospi gained 0.52% even as May industrial output fell 2.9% m/m; Japan’s output rose a modest 0.5% m/m. Australia’s ASX 200 added 0.33%. India’s Nifty 50 and Sensex dipped 0.29% and 0.2%. Notable movers included a 67% surge in Thai coconut water maker IFBH on its Hong Kong debut and a 4% drop in Li Auto after cutting its H2 delivery outlook. U.S. futures rose, following record closes for the S&P 500 and Nasdaq and a strong Dow, as markets remain sensitive to global trade negotiations.

Entities: China manufacturing PMI, CSI 300, Hang Seng, Nikkei, Kospi • Tone: analytical • Sentiment: neutral • Intent: inform

30-06-2025

Jim Cramer argues the market’s leadership has broadened beyond the “Magnificent Seven,” with two standout winners: financials and AI-driven data center infrastructure. He attributes the surge to a newly pro-business regulatory environment under Trump that’s easing M&A, IPOs, bank stress tests, and compliance burdens—driving multiple expansion for major banks, insurers, and asset managers. Simultaneously, a “space race” in generative AI is funneling capital from lagging enterprise software stocks into physical data center buildouts and semiconductors, benefiting grid and power equipment makers, data center operators, and chip companies. Cramer sees these trends as powerful, durable, and reshaping where retail and institutional money flows.

Entities: Jim Cramer, Magnificent Seven, financial sector, AI-driven data center infrastructure, Trump administration regulatory environment • Tone: analytical • Sentiment: positive • Intent: analyze

30-06-2025

U.S. stocks hit record highs on optimism around evolving tariff negotiations, despite a highly uncertain economic outlook. Atlanta Fed President Raphael Bostic said modeling is difficult amid constantly changing trade policies and noted businesses expect to raise prices but lack clarity on timing; many won’t finalize tariff strategies until 2026, implying prolonged effects on inflation and growth. While Fed Chair Jerome Powell favors holding policy until tariff impacts are clearer, markets now price multiple rate cuts this year, influenced partly by renewed Trump criticism of Powell and speculation about an early successor, which could heighten volatility and deter foreign investors. A partial U.S.-China framework and a U.S.-U.K. deal buoyed sentiment, though key issues like steel remain unresolved. Experts warn markets may be naive about trade complexities, with negotiations across major partners likely to drag on and keep tariffs elevated.

Entities: U.S. stocks, Federal Reserve, Raphael Bostic, Jerome Powell, Donald Trump • Tone: analytical • Sentiment: neutral • Intent: inform

30-06-2025

The U.S. dollar has fallen over 10% in the first half of the year—its worst start since 1973—driven by President Trump’s aggressive tariff agenda, inflation concerns, rising government debt, and waning confidence in the U.S.’s financial leadership. The weaker dollar makes overseas travel pricier for Americans and can deter foreign investment, complicating Treasury borrowing needs, while offering some support to U.S. exporters and pushing up import costs. Markets initially rallied on Trump’s reelection but reversed as unexpectedly high tariffs spurred fears of persistent inflation, economic weakness, and a broader shift away from U.S. assets. Despite the drop, the dollar remains strong by historical standards due to its high starting point. The decline has reshaped investment returns across currencies, nudging U.S. investors toward foreign markets, and raised doubts about Treasuries’ and the dollar’s traditional haven roles amid swelling deficits. Analysts warn that while full de-dollarization is distant, rising government debt heightens the risk.

Entities: U.S. dollar, President Trump, tariffs, inflation, U.S. Treasuries • Tone: analytical • Sentiment: negative • Intent: inform

30-06-2025

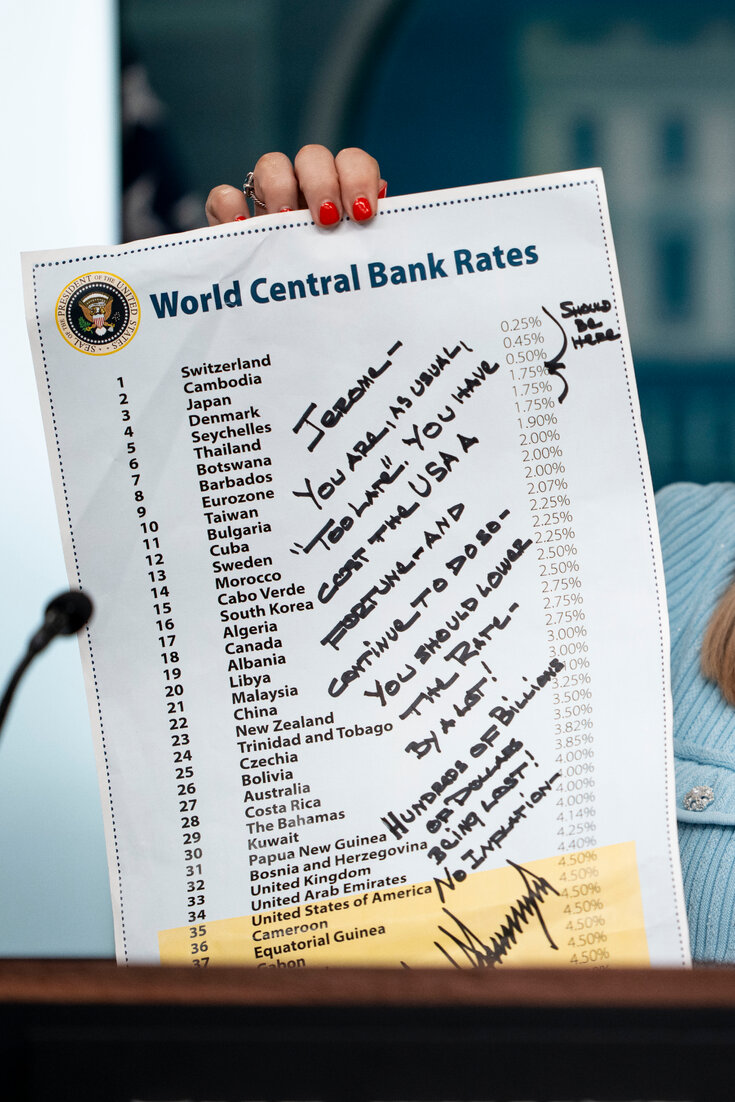

President Trump intensified pressure on Federal Reserve Chair Jerome Powell, sending a handwritten note accusing him of costing the U.S. “a fortune” and demanding substantial rate cuts. He also attacked the Fed’s Board on social media and suggested Powell should resign before his chair term ends in May, while floating naming a successor early via an upcoming board vacancy. Trump insists the next chair must be willing to lower rates, challenging the Fed’s independence, and has called for cuts of up to 2.5 percentage points from the current 4.25–4.5 percent range. The push comes as Republicans advance a deficit-raising tax-and-spending bill that would increase interest costs on the debt. Powell, in Portugal for an ECB conference, received public praise from ECB President Christine Lagarde. Trump has contrasted the Fed’s stance with recent rate cuts by the ECB and the Bank of England.

Entities: Donald Trump, Jerome Powell, Federal Reserve, ECB (European Central Bank), Christine Lagarde • Tone: urgent • Sentiment: negative • Intent: inform

30-06-2025

Cocona Labs, a Colorado company that makes moisture-wicking compounds for textiles, is considering moving parts of its production from the U.S. to China or India to avoid tariffs stemming from President Trump’s trade war. Despite Trump’s goal of reshoring manufacturing, Cocona’s CEO says China’s unmatched textile infrastructure and fluctuating tariffs have stalled orders, delayed R&D, and may force the firm to shift its master-batch manufacturing abroad to serve Chinese customers tariff-free. Initial tariff spikes (U.S. to 145%, China to 125%) eased to 30% and 10%, but ongoing uncertainty is pushing the 20-person company to prepare a rapid move that would take work from U.S. suppliers—an outcome the CEO calls paradoxical unless consumers accept higher prices.

Entities: Cocona Labs, United States, China, India, Donald Trump • Tone: analytical • Sentiment: negative • Intent: inform