Articles in this Cluster

23-06-2025

The article outlines Iran’s strategic options after US airstrikes on its nuclear sites amid ongoing Iran-Israel exchanges. Iran could: 1) Retaliate quickly and forcefully against US interests via proxy attacks on US bases in Iraq/Syria, naval “swarm” strikes, Houthi disruptions to shipping, cyberattacks, or even threatening the Strait of Hormuz—actions that risk major escalation; 2) Retaliate later with surprise attacks on US military, diplomatic, or commercial targets, risking renewed US strikes once tensions have cooled; or 3) Avoid retaliation and pursue diplomacy, potentially rejoining talks if it agrees to send all uranium abroad for enrichment—an outcome that averts further US attacks but risks making the regime appear weak domestically. The core calculus centers on regime survival, deterrence credibility, and the high escalation risks of hitting US assets.

Entities: Iran, United States, Israel, Strait of Hormuz, Houthi movement • Tone: analytical • Sentiment: neutral • Intent: analyze

23-06-2025

Secretary of State Marco Rubio said the U.S. is ready to meet with Iran after U.S. strikes on three Iranian nuclear sites aimed at degrading weaponization capabilities, emphasizing there are no plans for further attacks unless Iran targets Americans or U.S. interests. He warned that any Iranian move to close the Strait of Hormuz would be “suicidal,” likely uniting global opposition, and noted the U.S. can clear mines and defeat Iran’s navy if needed. Rubio argued Iran’s high-level uranium enrichment and missile development justify concern, and reiterated U.S. forces in the region will defend American personnel and bases if Iran or its proxies retaliate.

Entities: Marco Rubio, United States, Iran, Strait of Hormuz, Iranian nuclear sites • Tone: analytical • Sentiment: neutral • Intent: inform

23-06-2025

Asia-Pacific stocks mostly fell Monday as U.S. strikes on Iranian nuclear sites lifted geopolitical risk and initially boosted oil prices before a late pullback. Brent hovered near $76.75 and WTI near $73.60. Japan’s Nikkei (-0.13%) and Topix (-0.36%), Korea’s Kospi (-0.24%) and Kosdaq (-0.85%), and Australia’s ASX 200 (-0.36%) declined. Hong Kong’s Hang Seng (+0.67%) and China’s CSI 300 (+0.29%) rose, led by tech names like Li Auto and chipmakers. India’s Nifty (-0.33%) and Sensex (-0.44%) slipped.

Travel-related stocks across the region fell on oil and Strait of Hormuz disruption fears. Asia FX mostly weakened against the dollar, though the Aussie firmed. Japan’s flash PMIs showed manufacturing returning to expansion (50.4) and services improving (51.5). U.S. futures edged up after Friday’s mixed Wall Street session, where the S&P 500 and Nasdaq fell while the Dow inched higher. Ola Electric hit a record low after block trades. A Swiss private bank CIO urged shifting from U.S. Treasurys toward European bonds amid expectations of a softer dollar.

Entities: Asia-Pacific stocks, U.S. strikes on Iranian nuclear sites, Brent crude, WTI crude, Nikkei • Tone: analytical • Sentiment: neutral • Intent: inform

23-06-2025

European stocks opened lower as Middle East tensions escalated after U.S. strikes on Iranian nuclear sites. Iran’s parliament reportedly backed closing the Strait of Hormuz, raising oil supply risks. Defense stocks slipped, with Rheinmetall, Saab, and Thales down, while Poland’s Lubawa rose. The dollar strengthened as the yen weakened on oil dependency concerns; analysts see USD/JPY as a geopolitical hedge. Stellantis shares whipsawed after new CEO Antonio Filosa unveiled his management team. The Stoxx 600 fell about 0.4%, with oil and gas the only sector up; CAC 40 led declines. Markets are largely treating the conflict as contained, though oil and PMI data remain key watchpoints.

Entities: Stoxx 600, FTSE, DAX, CAC 40, Iran • Tone: analytical • Sentiment: negative • Intent: inform

23-06-2025

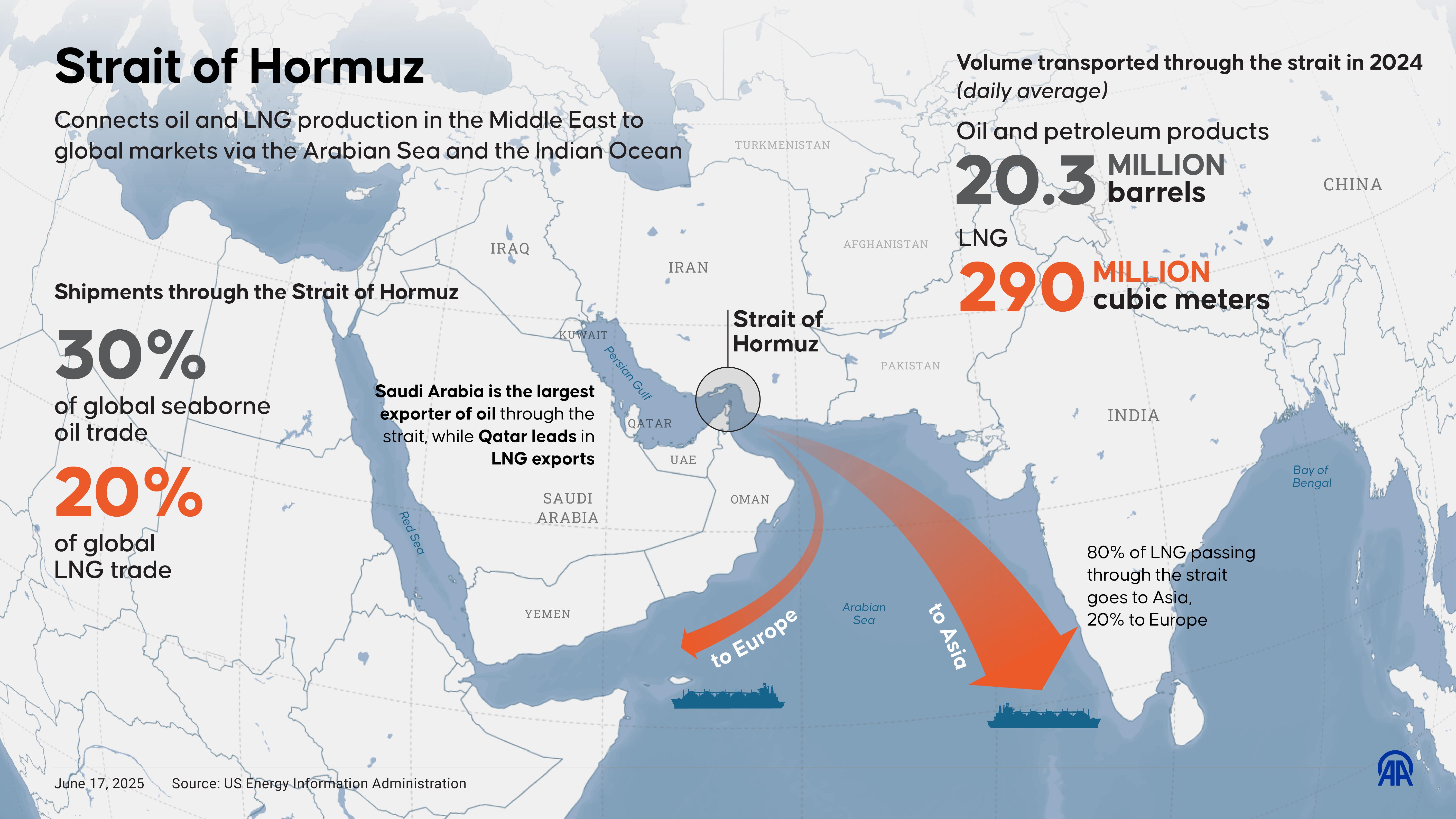

Iran’s parliament approved a measure to close the Strait of Hormuz after U.S. strikes on Iranian nuclear sites, but experts say an actual shutdown is unlikely. Analysts note Iran would harm itself most—alienating Gulf neighbors, threatening its own exports (1.5 million bpd via the strait), and risking backlash from China, its key oil buyer. The U.S. reports no current threats to shipping. Any Iranian move would likely be calibrated to nudge prices without triggering major retaliation. A closure or significant disruption could remove large Gulf supplies from the market, severely impact LNG flows from Qatar, and strain limited pipeline alternatives, posing upside risk to energy prices. Goldman Sachs estimates a brief Brent spike to around $110 under a partial, temporary flow reduction; current Brent is about $79.

Entities: Iran’s parliament, Strait of Hormuz, United States, Iranian nuclear sites, China • Tone: analytical • Sentiment: neutral • Intent: inform

23-06-2025

U.S. stock futures inched higher Monday despite escalating Middle East tensions after the U.S. struck three Iranian nuclear sites, raising oil and geopolitical risk. Dow futures rose ~0.1%, S&P 500 +0.3%, Nasdaq-100 +0.4%. Oil briefly spiked but WTI settled near $74, with strategists warning of a new, higher price baseline if risks to the Strait of Hormuz rise. Defense stocks gained premarket. Asia-Pacific markets mostly fell, while Gulf markets closed higher Sunday. The S&P 500 slipped 0.15% last week, its second straight weekly decline, while the Dow and Nasdaq posted modest gains. Bitcoin dropped below $99,000 amid a broad crypto sell-off tied to risk-off sentiment and heavy long liquidations. Investors remain focused on potential Iranian retaliation and implications for energy prices and global trade.

Entities: U.S. stock futures, Iran, Strait of Hormuz, S&P 500, Dow Jones • Tone: analytical • Sentiment: neutral • Intent: inform

23-06-2025

Global shipping traffic through the Strait of Hormuz is slowing as security risks rise following U.S. strikes on Iranian nuclear facilities. Bimco reports some shipowners have paused transits, and data suggests fewer vessels are entering the chokepoint, which handles about 20% of global oil and LNG flows. Major operators like Japan’s Nippon Yusen and Mitsui O.S.K. are minimizing time in the Gulf, while Hapag-Lloyd continues transits but is prepared to change course quickly. Insurers are likely raising premiums, and Iran’s parliament has backed closing the strait—though a final decision rests with its national security council—heightening fears of energy price spikes and broader regional escalation.

Entities: Strait of Hormuz, United States, Iran, Bimco, Nippon Yusen • Tone: analytical • Sentiment: negative • Intent: inform

23-06-2025

Oil markets face heightened uncertainty after the U.S. joined the Iran-Israel conflict, raising fears of supply disruptions and potential closure or harassment of the Strait of Hormuz, a chokepoint for about 20 million barrels per day. Analysts warn crude could approach or exceed $100 if the strait is significantly impaired or if Gulf energy infrastructure is attacked. While oil futures rose around 2% and volatility is near levels seen after Russia’s 2022 invasion of Ukraine, some experts note Hormuz threats are often rhetorical and both sides appear incentivized to avoid targeting energy assets. Nonetheless, traders expect elevated volatility and a risk of a sharper price spike if Iranian countermeasures escalate or passage through Hormuz is impeded for more than a brief period.

Entities: United States, Iran, Israel, Strait of Hormuz, oil markets • Tone: analytical • Sentiment: neutral • Intent: inform

23-06-2025

The article analyzes the aftermath of U.S. strikes on Iran’s nuclear facilities, noting Israel’s mixed relief and fear as America effectively joins the conflict. Iran, humiliated by sustained Israeli attacks and now U.S. action, faces intense pressure to respond but has limited options: a like-for-like strike on U.S. bases, symbolic retaliation to save face, or escalation targeting Gulf oil or the Strait of Hormuz—each carrying major risks. Iran’s proxy network is degraded, missile capacity diminished, and domestic legitimacy strained, leaving Supreme Leader Khamenei balancing hardliner demands for strength against the danger of provoking a devastating U.S. response. Washington hopes for a limited, face-saving move, but there are no good choices for Tehran.

Entities: United States, Iran, Israel, Supreme Leader Ali Khamenei, Strait of Hormuz • Tone: analytical • Sentiment: negative • Intent: analyze

23-06-2025

Israel and Iran exchanged new strikes Monday as tensions surged after U.S. bombers hit three Iranian nuclear sites over the weekend. Israelis sheltered from Iranian missile barrages while Israel targeted “military” sites in Tehran. The U.S. entry into the conflict raised fears of wider regional war and potential attacks on American forces by Iran-backed militias in Iraq and Syria. Washington said it seeks to avoid all-out war, but President Trump suggested regime change and claimed Iran’s nuclear program was “obliterated,” a characterization Pentagon officials tempered; the extent of damage at Fordo, Natanz, and Isfahan is unclear, and the whereabouts of near-weapons-grade uranium are unknown. Iran is weighing retaliation, including possible moves to disrupt the Strait of Hormuz, which could spike global energy prices. Asian markets fell on the risk. Diplomacy efforts accelerated: EU ministers met, NATO will take up the crisis, and the IAEA convened an emergency session with its chief urging de-escalation and offering to travel to Iran. U.S. officials warn Iran retains ample drones and rockets despite depleted medium-range missiles.

Entities: Iran, United States, Israel, Tehran, Pentagon • Tone: urgent • Sentiment: negative • Intent: inform

23-06-2025

A leading U.S. analyst says China is unlikely to deploy its navy to secure the Strait of Hormuz even if Iran threatens closure amid rising tensions. Instead, Beijing would rely on quiet, self-interested negotiations—similar to its deal with Yemen’s Houthi rebels to spare Chinese ships in the Red Sea—rather than policing global waterways. Despite heavy reliance on Middle Eastern oil, including increased Iranian crude, China’s response would prioritize economic interests over direct military intervention.

Entities: China, Strait of Hormuz, Iran, Yemen’s Houthi rebels, Red Sea • Tone: analytical • Sentiment: neutral • Intent: analyze