Articles in this Cluster

19-06-2025

The US Federal Reserve left its benchmark interest rate unchanged around 4.3% for the fourth consecutive meeting, despite worsening economic projections amid tariff-related uncertainty. Policymakers now expect slower growth (1.4% in 2024), higher unemployment (4.5%), and faster inflation (~3%) than forecast in March. Chair Jerome Powell said the Fed will wait and monitor how tariffs feed into prices, noting the economy remains solid with low unemployment. The path for potential cuts in 2025 is little changed, with rates seen just below 4% by year-end, while projections for 2026–2027 edged higher. President Trump continued pressuring for cuts, but the Fed emphasized its independence and a wait-and-see approach.

Entities: US Federal Reserve, Jerome Powell, interest rates, tariffs, inflation • Tone: analytical • Sentiment: neutral • Intent: inform

19-06-2025

Asia-Pacific stocks fell Thursday after the Fed held rates at 4.25%-4.5% but maintained guidance for two cuts later this year, while geopolitical tensions from the Israel-Iran conflict weighed on sentiment. Hong Kong’s Hang Seng dropped over 2%, China’s CSI 300 fell 0.82%, Japan’s Nikkei lost 1.02%, and Australia’s ASX 200 was flat; South Korea’s Kospi rose 0.19%. The U.S. dollar strengthened, pushing the Vietnamese dong to a record low and pressuring the Thai baht and Indonesian rupiah. Australia’s unemployment stayed at 4.1% for a fifth month. Aberdeen favored China, South Korea, and Europe equities on policy support and reforms. Nippon Steel completed its acquisition of U.S. Steel. On Wall Street, major indexes were little changed. Fed Chair Powell said the committee will assess tariff impacts on inflation; the Fed trimmed GDP and raised inflation forecasts. Jeffrey Gundlach said gold could reach $4,000 amid institutional demand and geopolitical risks.

Entities: Federal Reserve, Jerome Powell, Hang Seng Index, CSI 300, U.S. dollar • Tone: analytical • Sentiment: neutral • Intent: inform

19-06-2025

The Fed kept rates at 4.25%-4.5% and still projects two cuts in 2025, but raised its 2025 PCE inflation forecast to above 3% and trimmed growth to 1.4%, stoking stagflation concerns. Powell warned tariffs will push prices higher over coming months even as current data show resilient jobs, sentiment, and a soft May CPI. Markets and oil were mostly flat; Europe’s Stoxx 600 slipped while the FTSE 100 rose on in-line UK inflation. Geopolitically, Trump said he hasn’t decided on Iran strikes as the U.S. prepared evacuation options; JPMorgan said a regime change in Iran could profoundly disrupt oil markets. Separately, U.S.-EU talks face a deadline with steep reciprocal tariffs looming if no deal is reached.

Entities: Federal Reserve, Jerome Powell, PCE inflation, stagflation, tariffs • Tone: analytical • Sentiment: neutral • Intent: inform

19-06-2025

The Federal Reserve kept rates at 4.25%-4.5% and still projects two cuts in 2025, but raised its 2025 PCE inflation forecast to above 3% and cut growth to 1.4%, signaling concern about rising prices and slowing growth — potential stagflation. Chair Jerome Powell warned tariffs are likely to lift consumer prices in coming months, though current data remain resilient. U.S. stocks and oil were little changed; Asia-Pacific markets fell. Geopolitically, Israel’s President Herzog said regime change in Iran isn’t an official goal, while President Trump said he hasn’t decided on U.S. strikes on Iran. Despite tariff risks, institutional investors are turning more positive on emerging markets. Separately, India’s PM Modi rejected Trump’s claim of U.S. mediation in India-Pakistan ceasefire talks.

Entities: Federal Reserve, Jerome Powell, PCE inflation, U.S. tariffs, U.S. stocks • Tone: analytical • Sentiment: neutral • Intent: inform

19-06-2025

Volatile global markets and looming U.S. “reciprocal tariffs” have prompted a reassessment of emerging markets. Despite high proposed duties, Bank of America’s survey shows investors increasing exposure to EM equities to the highest since August 2023, expecting a much lower eventual average U.S. tariff (~13%). Asset managers argue EMs offer better valuations, less-crowded trades, stronger policy credibility, and earlier inflation-fighting than developed markets. New EM-focused products are launching, including Goldman Sachs’ EM Green and Social Bond ETF. Banks highlight specific opportunities: BofA and JPM favor Uzbekistan’s external debt on gold-driven fundamentals and potential ratings upgrades; broader picks include India, Brazil, Mexico, Indonesia, Vietnam, Saudi Arabia, Turkey, the UAE, Egypt, and the Philippines. Overall, managers see a potential regime shift benefiting the “Global South,” supported by demographics, supply-chain roles, and relative value—though near-term volatility remains high.

Entities: Bank of America, Goldman Sachs EM Green and Social Bond ETF, Uzbekistan external debt, U.S. reciprocal tariffs, Global South • Tone: analytical • Sentiment: neutral • Intent: analyze

19-06-2025

European stocks fell Thursday, with the Stoxx 600 down as Middle East tensions lifted oil prices and haven demand for the dollar. The Swiss National Bank cut rates by 25 bps to 0% amid mild deflation and backed tougher capital rules for UBS, including fully deducting foreign subsidiaries from CET1, while noting UBS’s substantial loss potential under stress scenarios. The Bank of England was expected to hold rates with inflation still above target; sterling dipped ahead of the decision. Teleperformance rebounded over 3% after a sharp sell-off on AI disruption fears following its strategy update, though shares remain deeply down from 2022 highs. Energy stocks rose; telecoms were slightly higher as Vodafone named a new CFO. Central bank decisions from Turkey, Norway, Switzerland, and the UK were in focus; U.S. markets were closed for Juneteenth.

Entities: Stoxx 600, Swiss National Bank, UBS, Bank of England, Teleperformance • Tone: analytical • Sentiment: neutral • Intent: inform

19-06-2025

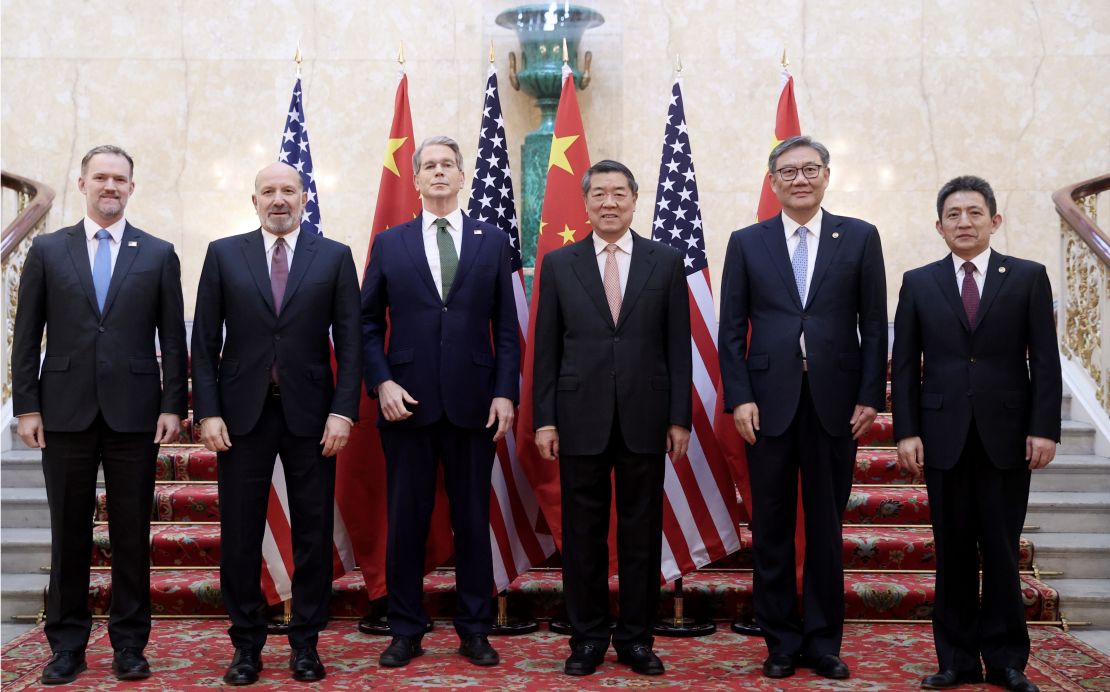

CNN reports that while the U.S. touted a new trade “framework” with China as a win, Beijing emerged feeling more empowered, having learned the value of its leverage—especially its dominance in rare earth minerals critical to U.S. industries. The deal, reached in London and restoring elements of a May truce, leaves elevated U.S. tariffs in place and requires final sign-off by Presidents Xi and Trump. China agreed to speed rare earth export approvals after U.S. pressure mounted amid supply shortages, while Washington pledged to roll back punitive measures tied to those delays. Analysts say China now sees the U.S. as more eager for a deal and recognizes its bargaining power through control of critical minerals, even as China’s public messaging remains muted and broader economic negotiations and tariff relief remain uncertain.

Entities: China, United States, rare earth minerals, U.S. tariffs, Xi Jinping • Tone: analytical • Sentiment: neutral • Intent: analyze