Articles in this Cluster

17-09-2025

Asia-Pacific markets traded mixed on Wednesday as investors awaited the outcome of the U.S. Federal Reserve's two-day meeting, where it is expected to cut interest rates. Japan's Nikkei 225 index was flat, while the Topix index fell 0.4%. Australia's ASX/S&P 200 retreated 0.63%, and South Korea's Kospi index lost 0.75%. Hong Kong's Hang Seng Index climbed 1.35%, driven by a surge in Baidu shares after the Chinese language search provider announced a $618 million offshore bond offering. The U.S. equity futures were little changed ahead of the Fed meeting, and U.S. stocks were lower overnight as investors took profits ahead of the Fed outcome.

Entities: Asia-Pacific, U.S. Federal Reserve, Japan, Nikkei 225, Topix • Tone: neutral • Sentiment: negative • Intent: inform

17-09-2025

European markets are expected to open higher on Wednesday as investors await the US Federal Reserve's monetary policy decision, widely anticipated to be a 25 basis point interest rate cut. The UK's FTSE, Germany's DAX, and France's CAC 40 are all projected to rise. The Fed's 'dot plot' grid will also provide insight into their outlook for rates over the next year. Meanwhile, UK inflation figures showed steady annual price growth at 3.8% in August. US Treasury Secretary Scott Bessent expressed optimism about ongoing US-China trade talks, suggesting further discussions before punitive tariffs take effect in November. US President Donald Trump's state visit to the UK is also underway, with meetings with UK Prime Minister Keir Starmer scheduled for Thursday.

Entities: European markets, US Federal Reserve, Jerome Powell, Scott Bessent, Donald Trump • Tone: neutral • Sentiment: positive • Intent: inform

17-09-2025

The article discusses the stock market's reaction to the upcoming Federal Reserve monetary policy decision on Wednesday. Stock futures were little changed as traders awaited the decision, with a 96% chance of a 25 basis point rate cut priced in. The Fed's "dot plot" grid and Summary of Economic Projections will also be closely watched for insight into future rate decisions. The article also mentions Cytokinetics' shares rising in after-hours trading after the company announced plans to raise $550 million.

Entities: Federal Reserve, S&P 500, Nasdaq-100, Dow Jones Industrial Average, Paul McCulley • Tone: neutral • Sentiment: neutral • Intent: inform

17-09-2025

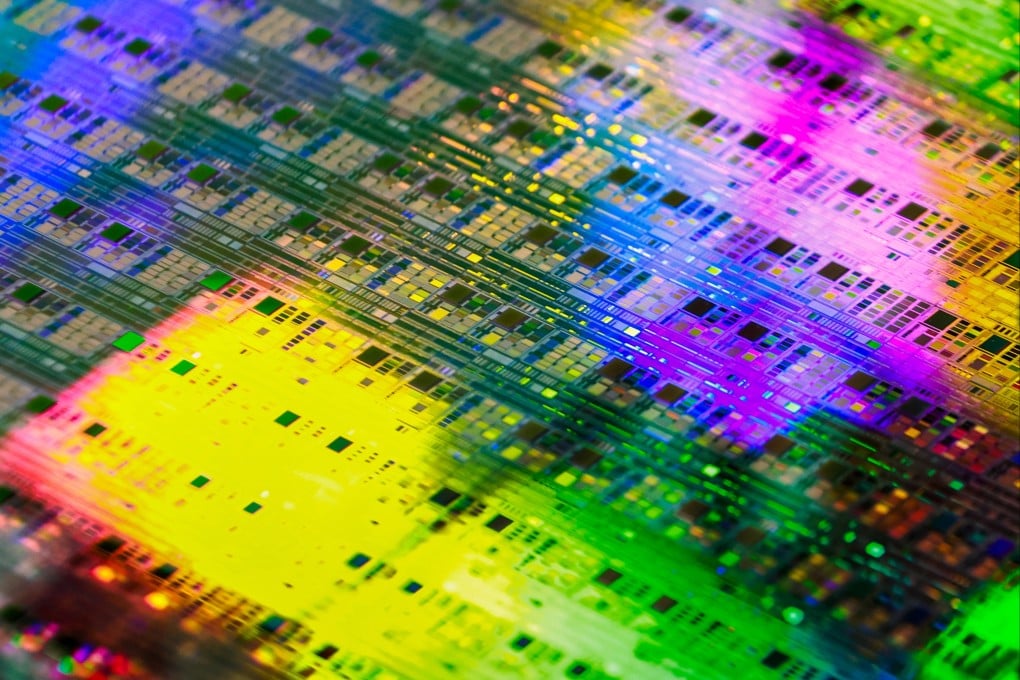

The article reports that chipmakers have posted their longest winning streak since 2017, driven by growth in the AI sector. The Philadelphia Stock Exchange Semiconductor Index rose 0.3% in its ninth straight positive session, with an 8.7% gain over the period and a 22% increase this year. Notable chipmakers such as ON Semiconductor, Intel, and Applied Materials saw gains, while Nvidia fell 1.6% despite being up over 30% this year. Analysts attribute the growth to the increasing demand for semiconductors driven by AI infrastructure development, citing Oracle's earnings report and Microsoft's deal with Nebius Group as bullish signs. Experts believe that the demand for semiconductors will remain sustainable, with Nvidia and Taiwan Semi being major beneficiaries.

Entities: Philadelphia Stock Exchange Semiconductor Index, ON Semiconductor, Intel, Applied Materials, Nvidia • Tone: positive • Sentiment: positive • Intent: inform